-40%

Carter Hawley Hale Stores, Inc. Stock Certificate

$ 1.58

- Description

- Size Guide

Description

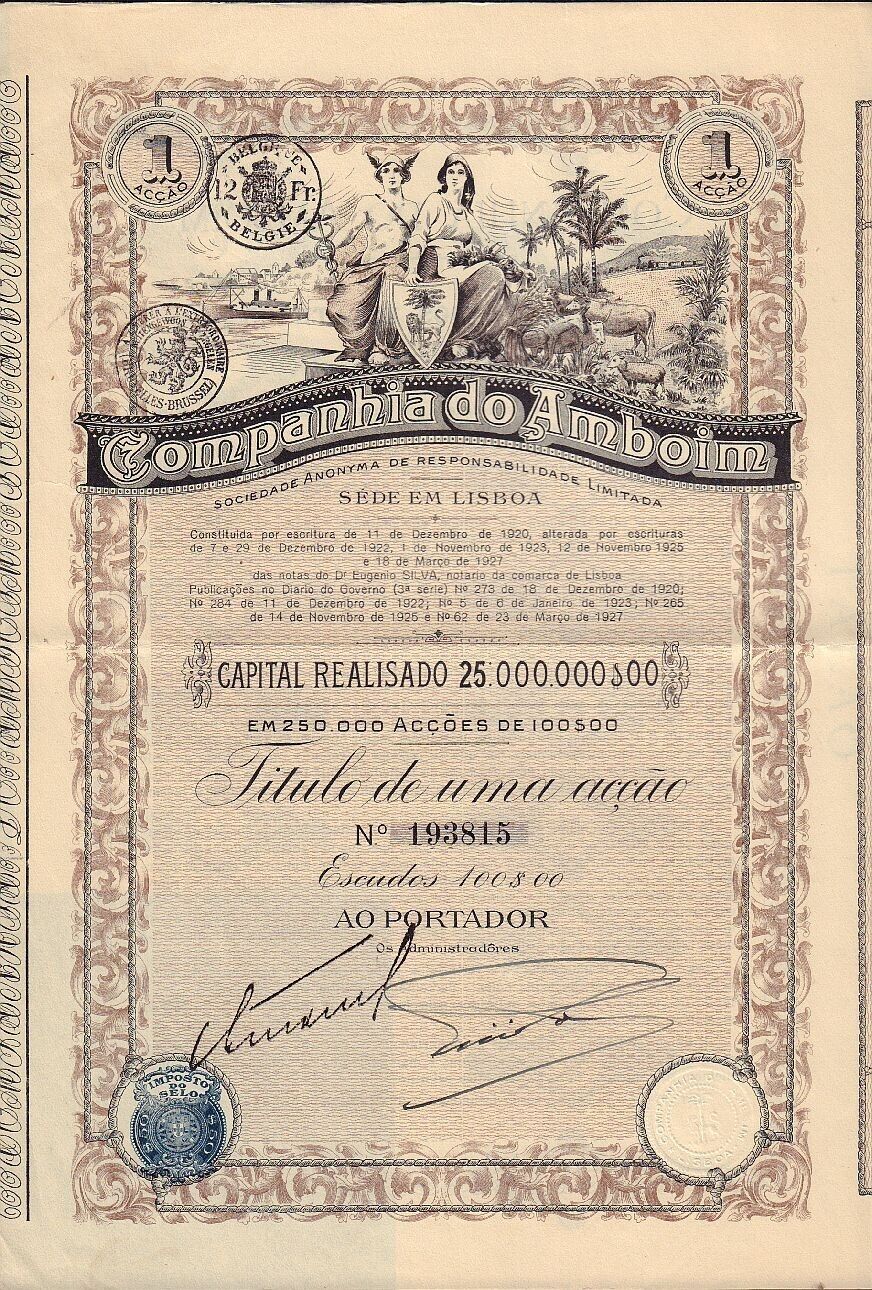

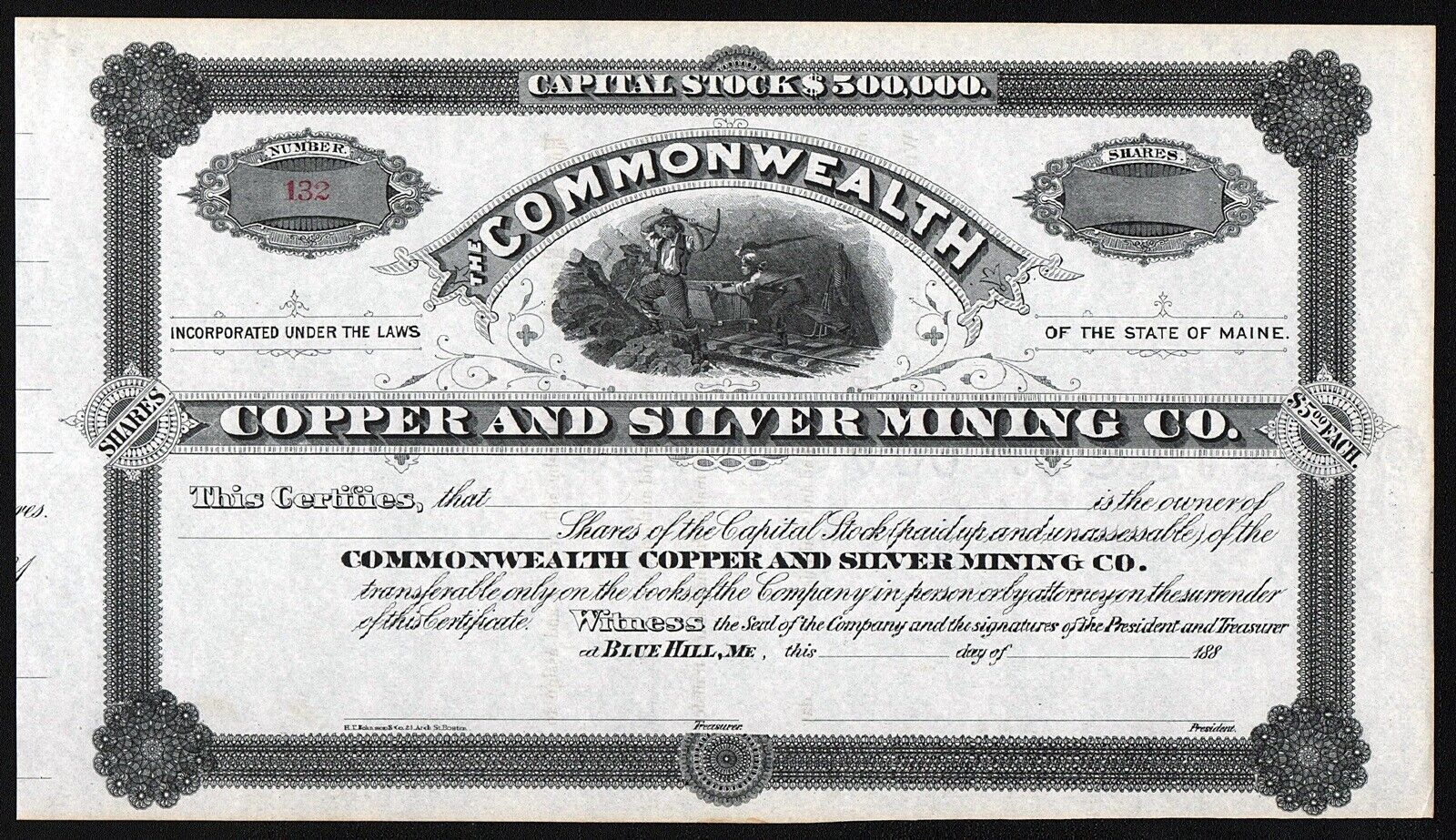

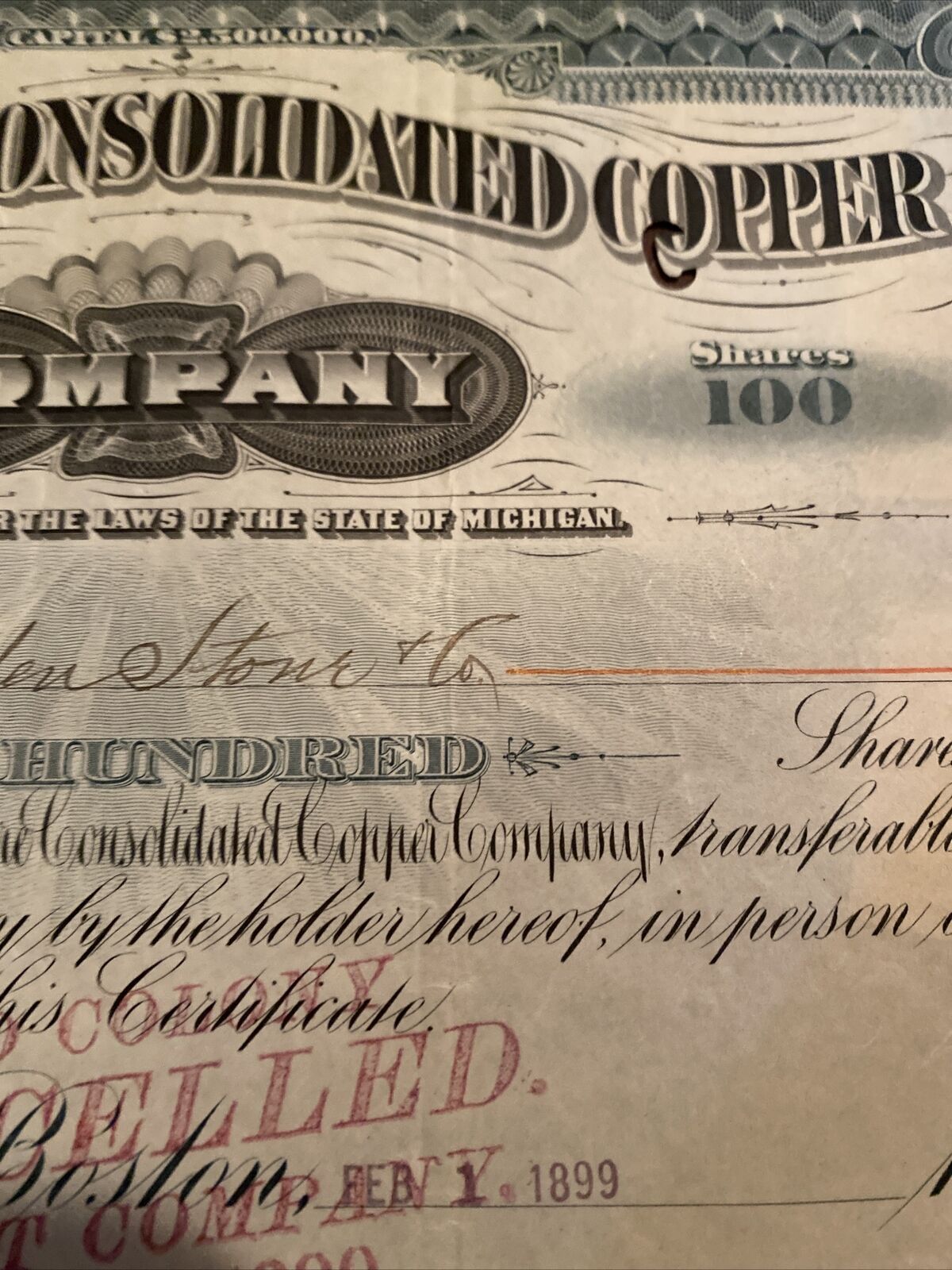

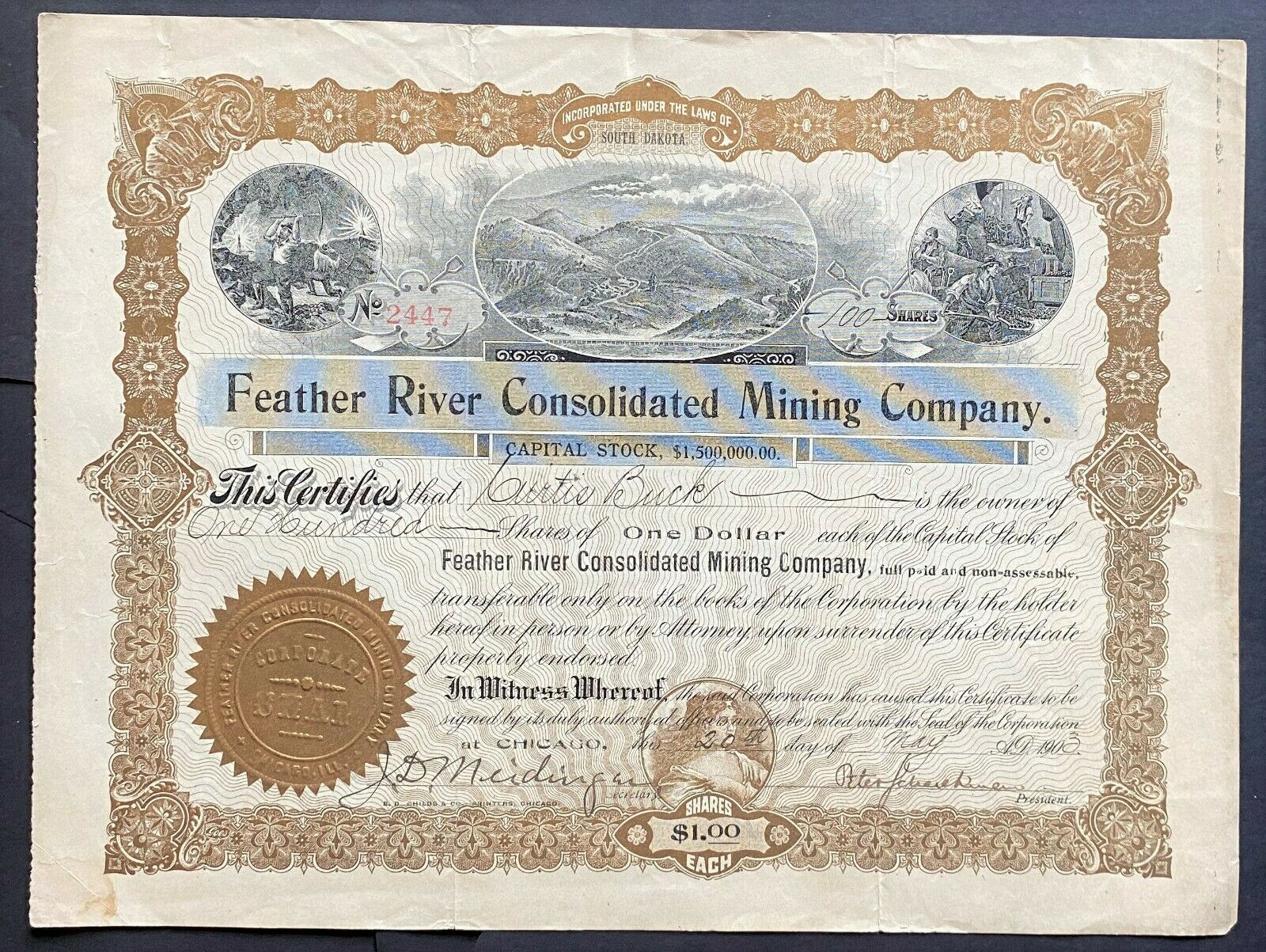

Product DetailsIntricately engraved antique stock certificate from Broadway-Hale Stores, Inc. dating back to the 1970's. This document, which contains the printed signatures of the company Chairman of the Board and Secretary, was printed by the Jeffries Bank Note Company, and measures approximately 12 1/8" (w) by 8" (h).

The vignette features a female figure holding a scroll in front of a city skyline.

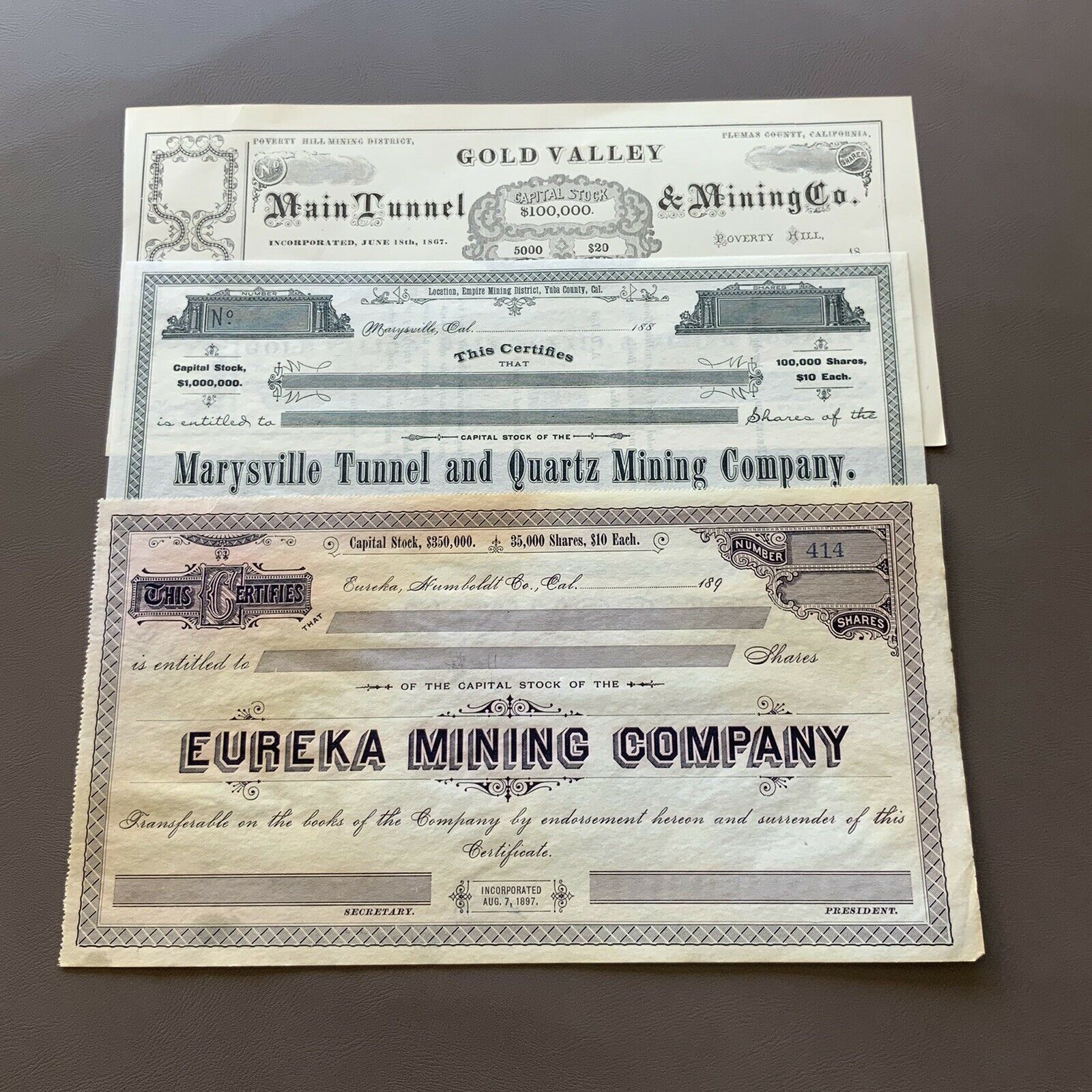

Images

The images presented are representative of the piece(s) you will receive. When representative images are presented for one of our offerings, you will receive a certificate in similar condition as the one pictured; however dating, denomination, certificate number and issuance details may vary.

You will receive the exact certificate pictured.

Historical Context

In 1984, was the largest on the West coast, and sixth largest in the country. Based in , its nationwide empire stretched from trendy LA bargain basements to tiny boutiques on 's famous Fifth Avenue, with a bookstore chain in between. Operating under the CHH flag were Bergdorf-Goodman, The Broadway, Contempo Casuals, Emporium-Capwell, Hole Renfrew, Neiman-Marcus, Thalimers, Walden Books, John Wanamaker, and Weinstock’s.

The chief executive of this diverse conglomerate since 1973 was Philip M. Hawley. He had led the company on an ambitious acquisition drive, increasing revenue threefold.

Despite the strength of the company’s franchise, however, there was a widespread belief that weak management was dragging down the company’s earnings, reflected in Wall Street’s favorite saying about the company: “God gave them Southern California and they blew it.” Hawley’s acquisition program had resulted in enormous growth in sales, but not in profits. The company’s net earnings had barely grown in the ten years of Hawley’s stewardship.

On two separate occasions, The Limited, Inc. attempted a hostile takeover of the company – but failed each time, finally withdrawing the second offer after the company restructured to fend off the attack.

At first, the employee-shareholders appeared to have made out like bandits. CHH stock reached a peak of nearly during the period following The Limited’s second bid, but by the end of 1987, CHH’s stock had plunged to around . Over the next four years the company failed to live up to the projections provided in the 1987 restructuring prospectus. The stock continued on its downward spiral, reaching a low of less than a share in late 1990. The company filed for Chapter 11 bankruptcy protection on February 11, 1991.